Image

This year House Bill 7063, the largest tax relief package in Florida’s history, was signed into law by Governor Ron DeSantis on May 25th. This tax relief package included the 2023 Disaster Preparedness Sales Tax Holiday, which provides residents with the opportunity to purchase qualifying disaster preparedness supplies tax-free during two 14-day sales tax holidays. During these two 14-day sales tax holidays, Floridians are projected to save $144 million on critical disaster preparedness supplies.

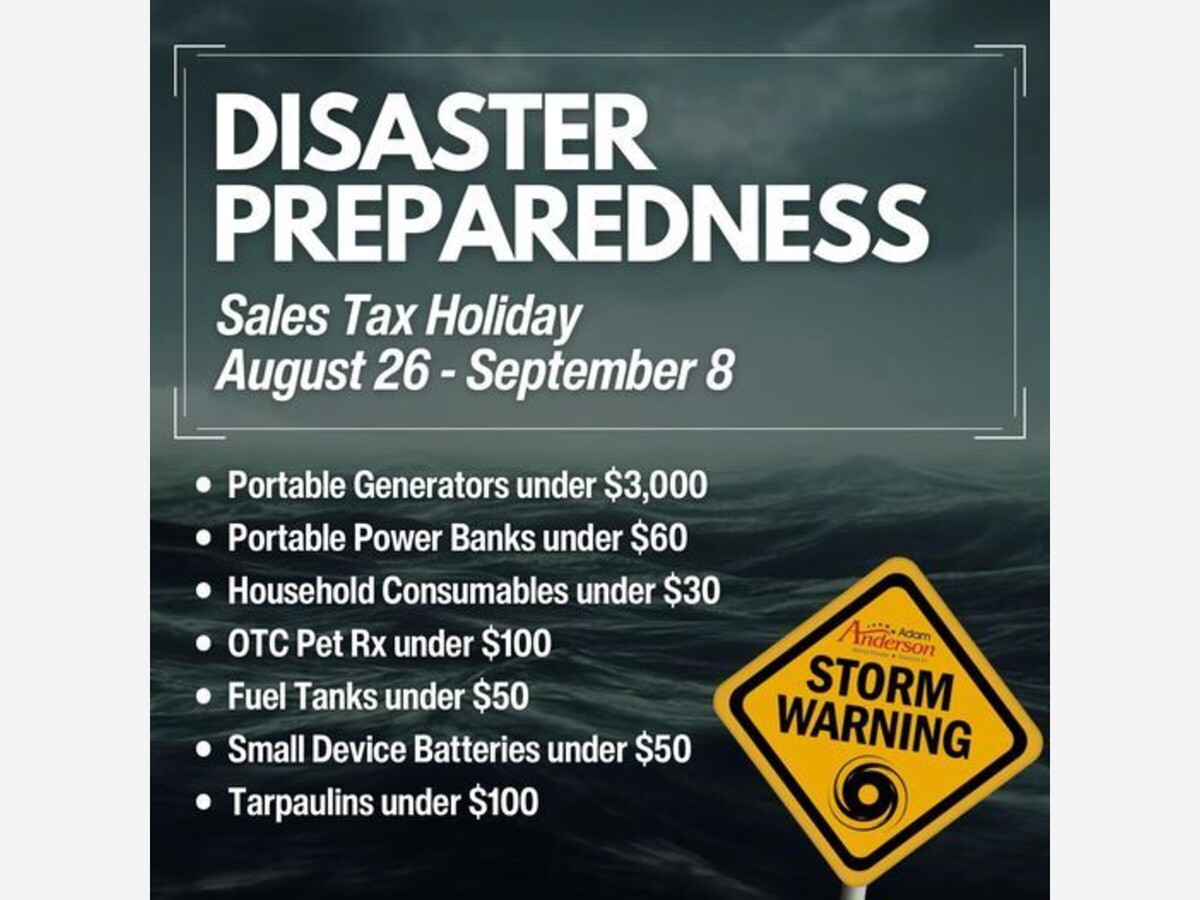

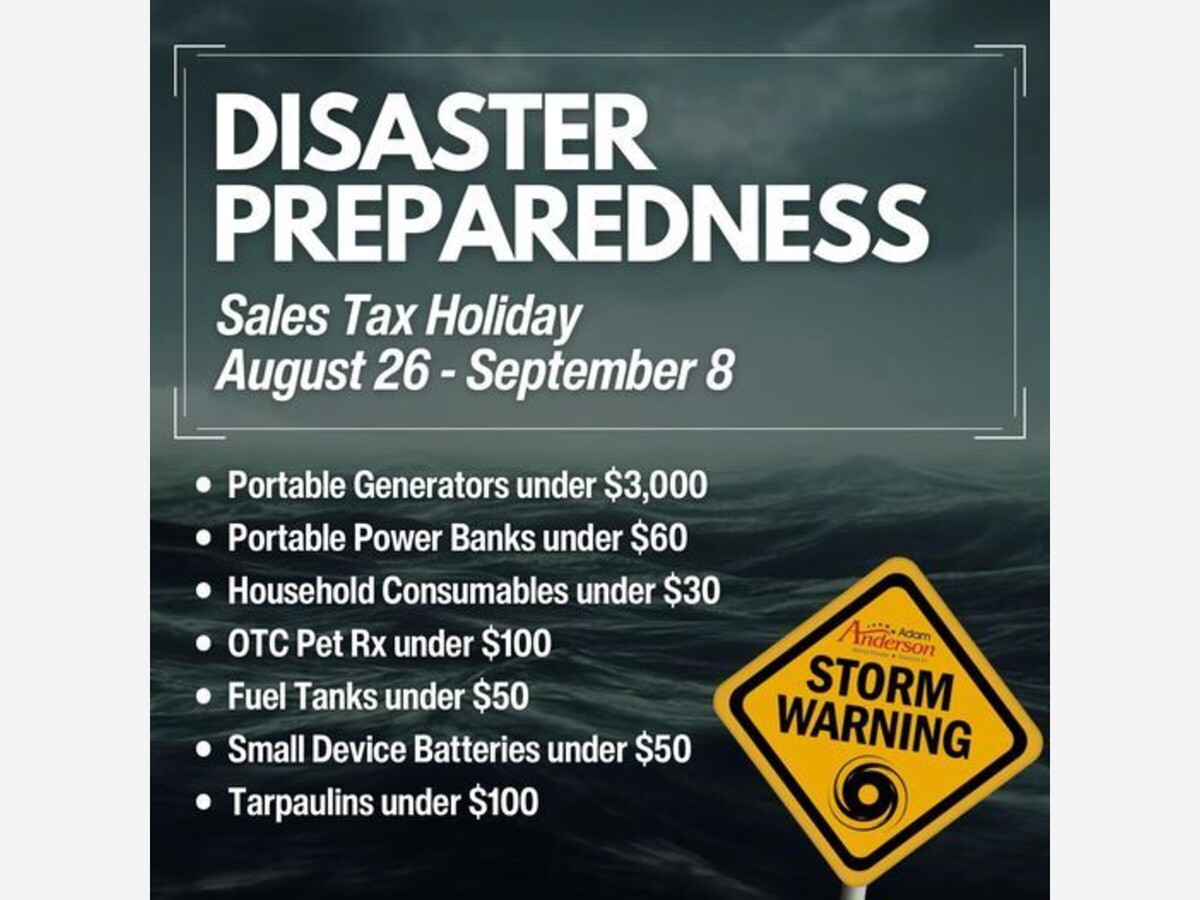

Each year, the Florida Division of Emergency Management encourages residents to take advantage of this tax holiday to prepare for hurricane season. The 2023 Disaster Preparedness Sales Tax Holidays will take place Saturday, May 27, through Friday, June 9, and Saturday, Aug. 26, through Friday, Sept. 8.

Eligible items include:

A full list of tax-free items is available at FloridaRevenue.com/DisasterPrep.

The Division encourages residents to stock a disaster supply kit that can last the entire household, including pets, for at least seven days. The Division’s complete disaster supply kit checklist is available for download at FloridaDisaster.org/Kit.